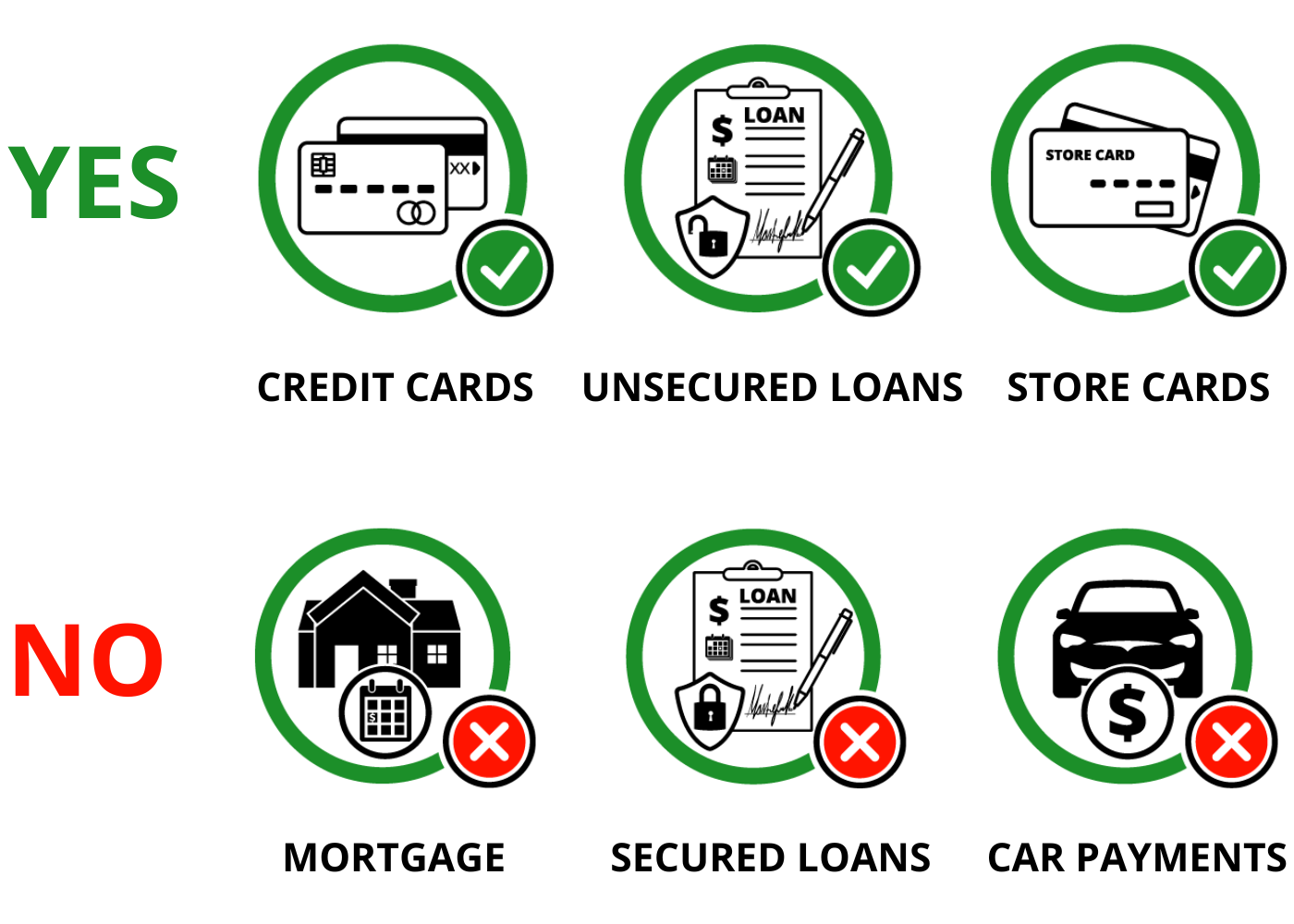

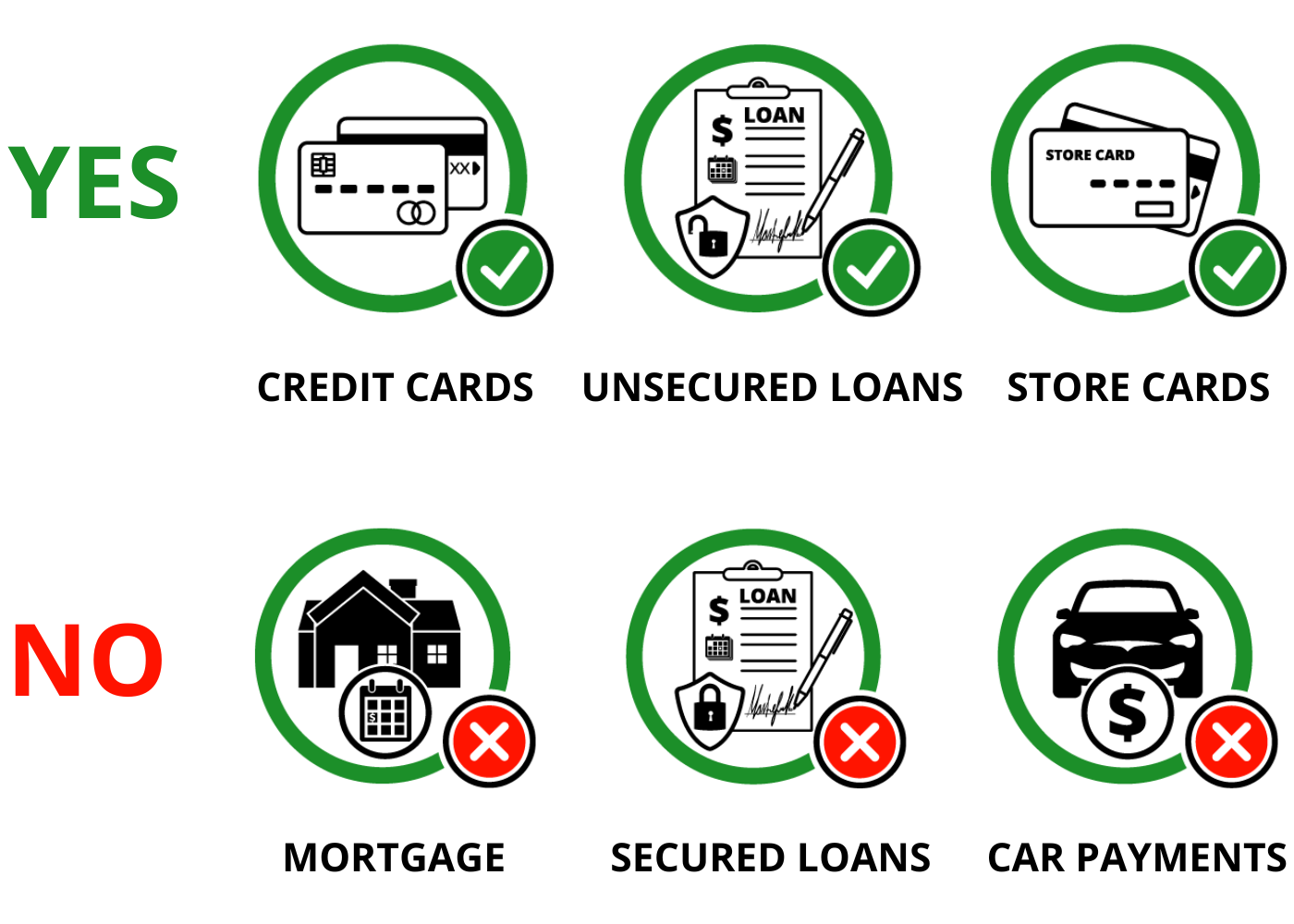

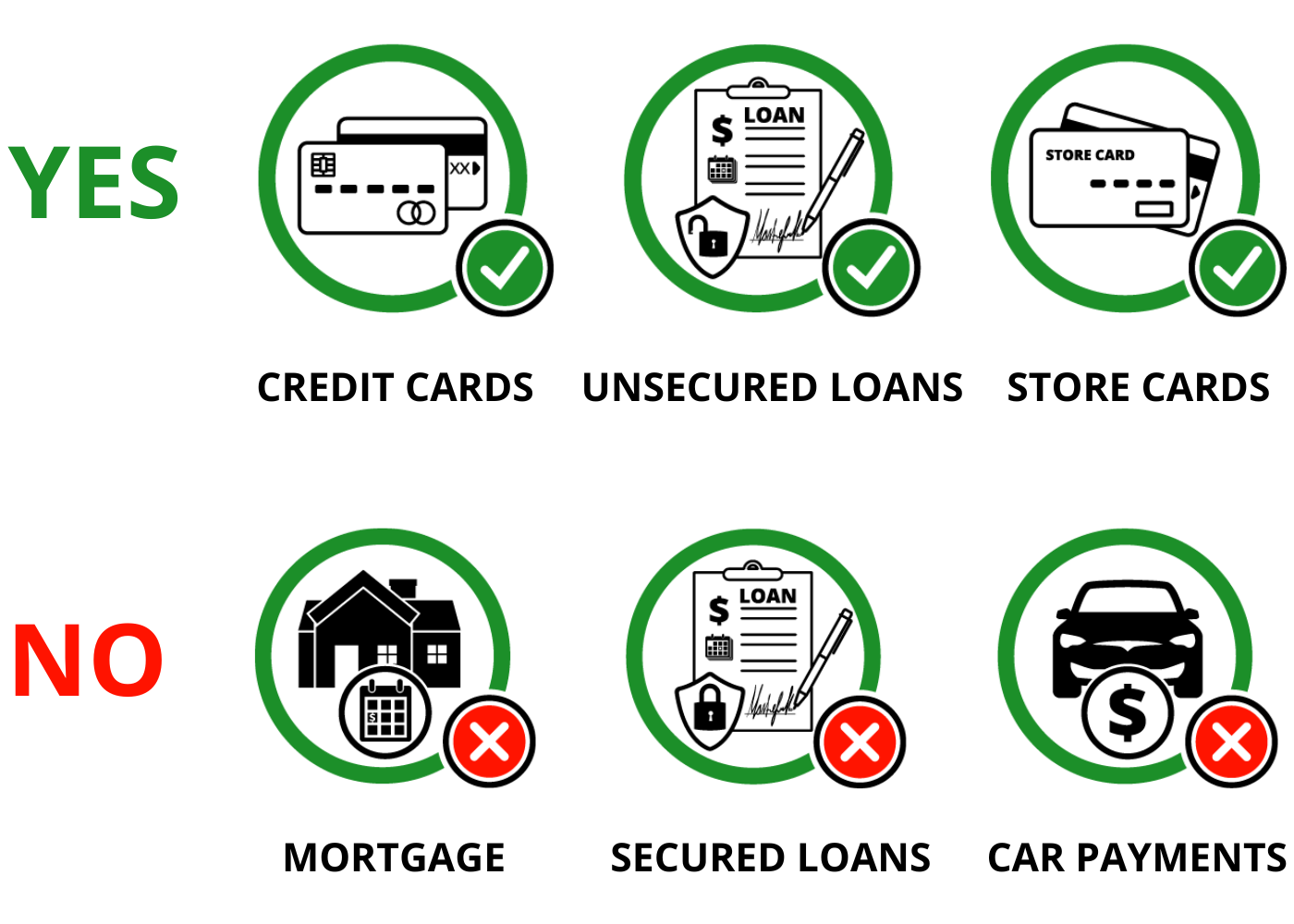

Which debt types qualify & which types do not?

Our programs accept unsecured debt, meaning debt that is not backed by any collateral. The primary qualified debts include credit card balances, store card balances, and unsecured (personal) loans. However, we may be able to enroll additional unsecured debt types, including: outstanding medical bills, collections, private (non-federal) student loans, & more.

Choosing us means putting your trust in a reputable partner committed to guiding you towards financial freedom. Our dedication to your success is reflected in our approach and the results we've achieved for hardworking Americans who have been struggling with debt. Here’s why so many have chosen us as their trusted partner in navigating debt relief:

- Customized Solutions: We understand that each financial situation is unique. That’s why we offer personalized plans tailored to fit your specific needs, ensuring a strategy that’s just right for you.

- Unmatched Expertise: Our team is composed of seasoned experts who are deeply knowledgeable about debt settlement strategies that work. We're equipped to navigate the complexities of debt relief on your behalf.

- Transparent Communication: Honesty and transparency are at the core of our operations. We educate you on your options and the process for each, ensuring you have all the necessary information to make an empowered decision about your financial future.

- Commitment to Your Success: Our goal is to see you succeed. There is ongoing support and guidance available, from your initial consultation through to the day you become debt-free.

Your trust is something we strive to earn and keep. We are dedicated to providing not just immediate relief but also long-term financial well-being. Let us show you how we can help you take back control of your finances.

If high-interest credit card debt is overwhelming you and making it hard to manage minimum payments, we are here to offer support. Programs are available which are particularly suited for individuals facing significant unsecured debt and financial challenges, caused by various hardships like unforeseen expenses, health issues, divorce, or job loss. Should you find yourself just scraping by with minimum payments while your debt continues to increase, there are programs available that can help. You can save money each month and also shorten how long you pay. Why continue struggling against rising debt alone when there are debt relief options available that can provide the help you need now?

Definitely! Your Debt Consultation Specialist will work with you to develop a program that suits your financial situation. We do more than just confirm you can manage the costs of a debt relief program—we carefully examine your budget to tailor a plan specifically designed to alleviate your financial strain and ease your worries.